Masayoshi Son is once again at the helm as Japan’s wealthiest, riding a 60% surge in SoftBank Group’s share price this year. Many investors are now backing his bold bets in artificial intelligence, which have clearly resonated with the market.

Masayoshi Son is once again at the helm as Japan’s wealthiest, riding a 60% surge in SoftBank Group’s share price this year. Many investors are now backing his bold bets in artificial intelligence, which have clearly resonated with the market.

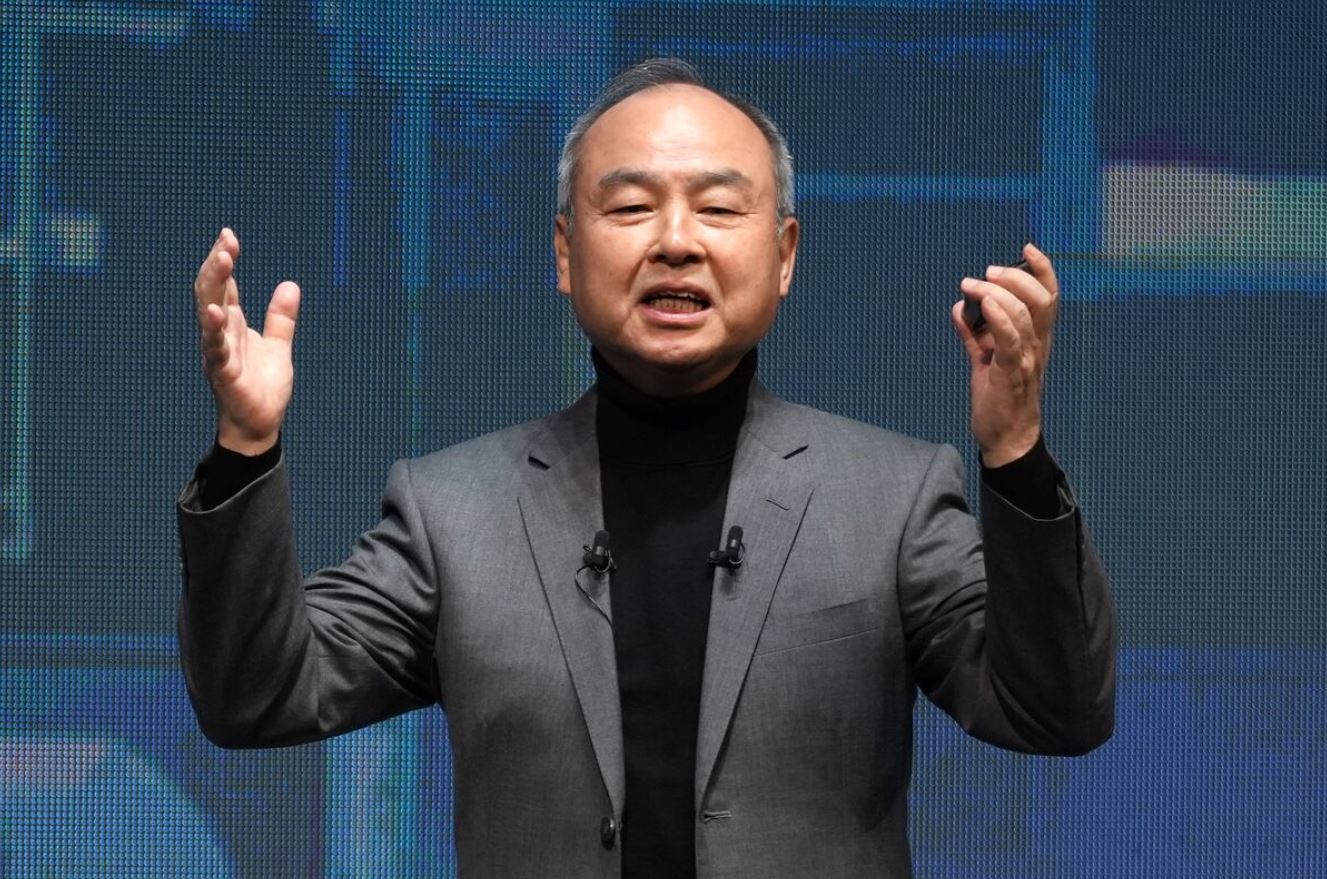

At 68, Son, as both chairman and CEO of SoftBank, is proving that a mix of strategic vision and calculated risk can pay off. After losing his top position in 2022 due to significant losses from the Vision Funds, he’s reclaimed his status by surpassing Tadashi Yanai of Fast Retailing. Forbes now estimates his net worth at $50.5 billion, marking a notable rise from his previous peak of $45.4 billion in 2021.

Investors have been particularly excited by SoftBank’s deep dive into AI, highlighted by its high-profile partnership with OpenAI, the creator of ChatGPT. The partnership not only kicked off the ambitious $500 billion Stargate AI infrastructure project but also saw SoftBank lead a $40 billion funding round, with the firm planning to invest up to $30 billion overall. Such strategic moves illustrate SoftBank’s efforts to position itself at the cutting edge of technology.

To further strengthen its AI credentials, SoftBank has boosted its stakes in tech giants like Nvidia and snapped up shares in Oracle and Taiwan Semiconductor Manufacturing Company (TSMC). Even Arm Holdings, mostly owned by SoftBank and traditionally a software company, is now venturing into semiconductor manufacturing to keep pace with the rising demand for faster data processing.

The latest financial results back up this aggressive strategy. SoftBank reported a net income of 421.82 billion yen (roughly $2.9 billion) for the quarter ending in June, a dramatic turnaround from a loss of 174.3 billion yen a year earlier, along with a 7% year-over-year revenue increase. While the stock still trades at a discount to its net asset value—a concern for some investors—the narrowing of this discount suggests growing confidence in the company’s future direction.

There are, however, a few cautionary notes. Chief Financial Officer Yoshimitsu Goto mentioned that progress on the Stargate project has been slower than expected, with delays in both site selection and financing for the needed data centers. Some analysts, including those at Morningstar and Deutsche Bank, point to potential debt risks should SoftBank continue raising funds through asset sales. In fact, the company already sold $4.8 billion of T-Mobile shares in June, and further moves cannot be ruled out.

If you’ve ever wondered where to find a blend of tradition and innovation in tech, SoftBank’s renewed focus on AI might spark renewed confidence. As market dynamics evolve, keeping an eye on these strategic shifts could offer some valuable lessons in navigating tech’s ever-changing landscape.